How DSI Can Protect Your Business & Employees

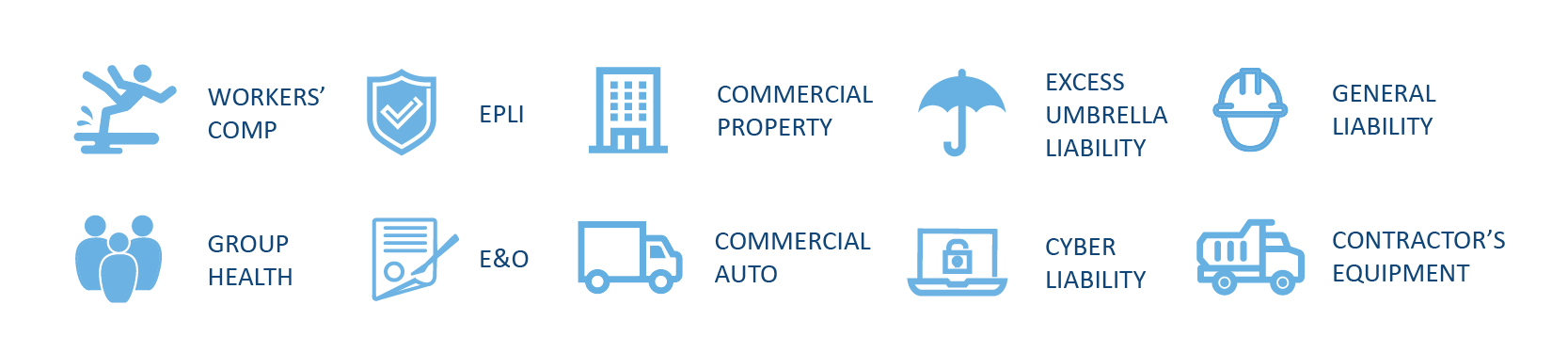

DSI is an expert in identifying your exposure and matching you with the insurance carrier that will make sure that you and your business are covered.

Contact us or call (888) 337-9322.

DSI Answers Your Commercial Insurance Questions

Do I need professional liability insurance?

If you provide professional service(s) or advice to your clients, you need Professional Liability or E&O (Errors and Omissions) coverage.

If I own a small business with very few staff, do I still need workers’ compensation?

All employers are subject to workers' compensation law and are expected to cover costs when an employee gets injured. No matter how many employees you have, your business needs workers' compensation coverage.

Why does my business need EPLI coverage?

Every business with employees or customers needs EPLI. According to the EEOC.gov, more than 1/3 of employee lawsuits are made against small businesses.

EPLI provides financial protection from a variety of claims of discrimination and retaliation on three levels: employer to employee, employee to employee, and employee to customer.

Do cyber attacks and breaches happen easily?

Did you know that 36% of all targeted cyber attacks are directed at businesses with 250 or fewer employees? A cyber attack can be as simple as an employee opening a malicious email attachment or leaving a computer unintentionally unlocked and unattended. Ask your DSI Agent about cyber liability coverage.

|